While around 60% of us make New Year’s resolutions, only about 8% of us achieve them. Yikes. With that not-so-motivating statistic in mind, how are you doing with your New Year’s resolutions, if you’ve made any?

With everything we all experienced in 2020, it’s totally understandable if you made fewer resolutions this time around…or none at all. However, if you set a general goal to get your finances in check, we can help. Let’s talk about how you can make sure your budgeting sticks in the months to come.

Know your motivation

Avoid starting a budget because it’s part of being an “adult,” or something you feel like you have to do. There are plenty of people in the financial advising profession who will tell you why it’s important to budget. But why is it important to you?

Get personal with your reasons for budgeting. That’s far more motivating than evaluating your finances for the sake of it.

Plus, setting specific goals for your budget can keep your focus on the positives rather than the negatives. For example, it might be harder to budget if your motivation is to pay all your bills or cut down on spending. Instead, shift the focus to reducing your stress (by making sure your bills are taken care of) or building your child’s college fund (by cutting down on spending).

Schedule periodic revisits

Science says it can take anywhere from 18 to 254 days for a person to form a new habit. Why such a broad range? Probably because not all behaviors are created equal, and of course, some people find it easier to form new habits than others.

It also takes about 66 days for a new habit to become automatic. If you’ve ever tried a new workout routine or given up carbs as part of your New Year’s resolutions, you know that getting used to change is often the hardest part! But it’s worth seeing it through to turn a new behavior into a habit you don’t even think about.

That’s why checking in with your budget consistently can help you form a healthy financial habit. Right off the bat, schedule periodic revisits to your budget. Once a month, once a week, once a quarter, whatever works for you. If you’re budgeting with your spouse or partner, create a recurring calendar event and both of you RSVP. No canceling when the time comes!

Bonus tip: I schedule my budget revisits for while I’m working at the office. It helps to do it in that environment because my brain is in “work mode.” Being at the office helps me keep emotions out of it. Try having your budget meetings at your own office or at a coffee shop to keep things “professional.”

Slow and steady wins the race

We already talked about how long it can take for a new habit to form, and that it takes around two months for a new habit to become second nature. That means you have to be patient. Don’t expect your new budget to magically solve all your financial issues and stressors overnight. That’s a surefire way to demotivate you, and make it harder to stick to your budget.

So, take your time! Maintain a steady pace. Try not to rush to the finish line and hit all your big financial goals at once. If something in your budget doesn’t require you to get it done ASAP, then leave it for later.

The thrill of tackling a new challenge can wear off quickly if you don’t pace yourself. Remember that you’re trying to build a healthy lifelong financial habit. Your new budget isn’t a quick fix, nor should it be.

Use a budgeting system that fits you

Do you like the idea of budgeting apps, but hate all the tools you don’t use or ads that clutter up your screen? Do you like old-fashioned spreadsheets or balancing your budget on a notepad, but wish there was a better way to actually visualize your money?

Many people often fail to stick to a budget because they struggle to find a budgeting system that works for them. Budgeting apps can be overwhelming with too many features or nudges to upgrade to a paid subscription. Spreadsheets and pen-and-paper are prone to error, and writing every line item out can be tiring.

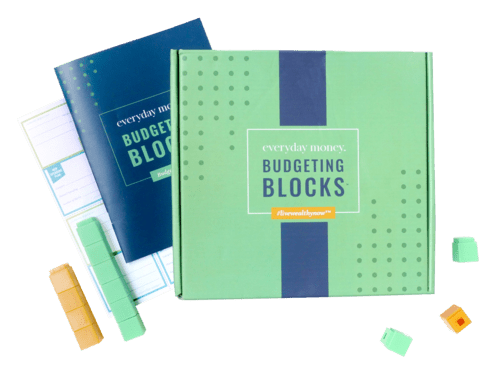

If you’ve ever felt this way about any of these budgeting systems, I encourage you to give BudgetingBlocks™️ a try. It’s an interactive budgeting process that uses colorful blocks and exercises to help you really see where your money is going and what it can do.

Want to see where your expenses can be trimmed or how you can pay down some of your debt? All it takes is playing and moving around your money “blocks.” If you stick with the BudgetingBlocks™️ system, revisit your budget periodically, and remain patient, I know you’ll change the way you feel and work with your money for the better. You got this!